|

| fotostorm |

Few years back I wrote about ways to teach kids to save money. My first-born son was just 4 years old back then. Now he's 13 years old, officially a teenager. How time flies right? By the way, in case you didn't know I have an almost 3-year old son again. So I have two boys!

Let's go back to saving money. As early as two years old, my eldest started his own savings account. Just last month, we have transferred his junior savings acount to a regular account. But before this, we talked to him about his savings and how it is important to have his own savings too.

I always tell and write about how the recent health pandemic made us realized the importance of saving money and having an emergency fund. Good thing it's over and I hope that everyone learned a lesson from it. As a parent, we always want to make sure about the future of our kids and the first thing we do is to save money for them.

It is not just saving money, I should say. But it's also about teaching them the importance of saving money and how to save money by themselves. Now, having a teenager is different from having a toddler. Let me share how to teach teenagers to save money.

Start them young

Teaching kids to save early is always on my first list. Kid's brains are like sponges taking in everything around them so teaching them to save early will make our job easier over time.

Setting up a savings account

Like what I have mentioned our teeanger already have his own savings account since he is 2 years old. Since he's already 13 years old, we can transfer it to a regular account with a passbook and an ATM card. We talked to him about his savings account to let him be aware that we save money for him and whatever he can save, he can also add up to that savings.

Give them a regular allowance

I let my son handle his allowance and watch how he spends his money. Mostly, he spends on food and the things he needs at school. However, if he still has money, he don't ask for his allowance. We are the ones reminding him if he still has money. And so we decided to give him a regular allowance and remind him to save half of it before spending.

Show them how you manage finances

Teenagers are sometimes carefree with money. Letting them know how we manage finances, our good practices, and discipline are the best examples we can give to our kids.

We let our teenage son go shopping with us for our household essentials. We always tell him to check and compare prices. Sometimes, when he wants something and sees the price, he will tell us that it's very expensive and he doesn't need it anyway. Aside from that, we tell him how much we earn per day so that he will remember it every time he spends money.

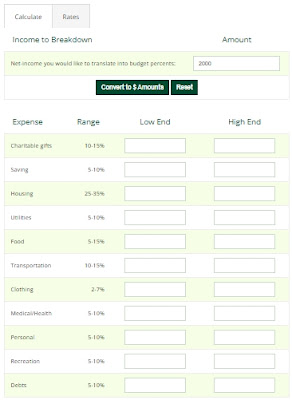

Let them be part of our monthly budget planning. To make it easier, you can use ae budget planning calculator like the one below.

Help them earn their own money

It's not necessary for them to have a part-time job. They can earn from their hobbies, like arts and crafts, cooking and baking, buying and selling, etc. If you have your own business, let them help and give them a commission. This will help them see the correlation between hard work and money earned. If they do their chores, they'll earn money, and if they don't, they earn nothing.

Teach them the consequences of having debts and overspending

Let them handle their money and make mistakes to learn the consequences. If they spend more than their allowance or budget, they need to learn which category of their budget they have overspent and cut it down next time. Teach them how to monitor their spending as well by keeping a pocket notebook where they can write their expenses.

Practice delayed gratifications

Practice delayed gratification with your teenagers and resist buying things they want versus what they really need. If your teenager wants a new phone, let them wait for a week or a month and ask if they really need it or just want to keep up with their friends or classmates. If they really want it, let them contribute to its cost by saving. Chances are, with time, the desire will likely fade. This also teaches them to save first.

Luckily, our eldest doesn't ask for too much of what we can afford. He knows what is expensive and what he can buy with the value of money. It's because he knows how hard we work to earn money, and I am always thankful for that. Both our sons are patient, and they are content with what they have.

To sum up, teaching our teenagers about money should not only be about how much is available for them and us, but also about establishing good money habits for their future. Let them commit money mistakes to learn its consequences and become financially responsible for themselves. Lastly, there's no one "right" way to teach our teens to save money because every lesson depends on them, on the family's financial status and capabilities, and on our values.