One of my goals this year is to save more. Last January, we started with the 52-week money challenge. I am happy to share that we are able to finish not just one but four 52-week money challenge for Daddy and I, for Matt, for my Nanay and for my in-laws. We finished the challenge earlier because when we got an unexpected blessings, we prioritize to save for these money challenges. It also helped that we did the reverse of the challenge so by the middle of the year, konti na lang. But hey, we did different increments and starting amount. Just enough to make my in-laws and Nanay happy this Christmas.

Aside from the 52-week money challenge that we finished, I focus on managing our hard earned money. This year, aside from our regular works, we also earn well from our online shop and our blogs. I want not just to earn but to save as well. So I have tried many budgeting techniques but only the envelope system works well with us.

So for months now, I kept several brown envelopes inside my wallet that makes it super bulky. Another thing is, the envelopes can easily be torn so I kept on changing it. Then, since I just kept these envelope inside my wallet, I always fear that it might get lost or stolen.

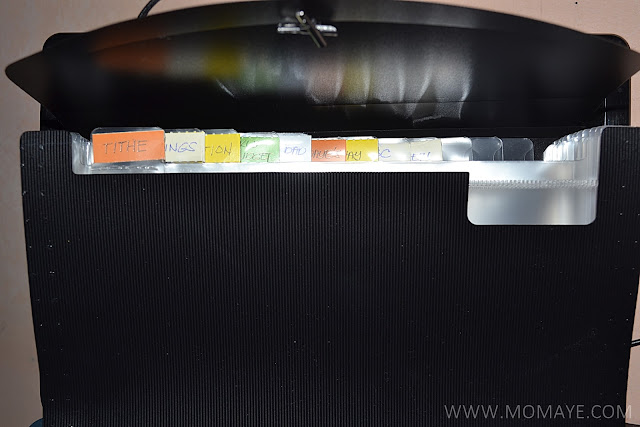

Fortunately, I saw one of the posts of Mommy Levy about expanding envelope. I immediately went to National Bookstore but there's no stock of a smaller one. Luckily, when we went to SM a week ago, I saw an expanding envelope but it's the last piece na. I bought it at 69.75 pesos only.

|

| Expanding Envelope |

No choice sa color kasi last one na nga, hehe. Pwede na atleast now I have separate temporary storage for the savings/bills payments/earnings. Temporary because it will be deposited to our savings bank account after.

|

| Expanding Envelope |

Medyo malaki sya for the money, as in papasok hanggang kaloob-looban but neat naman tingnan. Especially when you put the labels, which comes with the envelope.

|

| Expanding Envelope |

|

| Expanding Envelope |

For tithe, I get a fixed amount from our monthly income. God has been good to us that's why I also want to be a blessing to others.

Next is savings. This is where the 10% of our monthly income goes. I always get this first and hati hati na for the rest of the expenses. For me, mas magaan gumastos if you know you already have saved money.

You should also save for emergency fund in case something not good happens like when you lose your job (knock on wood, not) or when you have immediate or unplanned expenses. Emergency fund should be equivalent to at least your 6-month income. So it's for you to decide what's the percentage you will allocate for it every month or pay day.

You should also save for emergency fund in case something not good happens like when you lose your job (knock on wood, not) or when you have immediate or unplanned expenses. Emergency fund should be equivalent to at least your 6-month income. So it's for you to decide what's the percentage you will allocate for it every month or pay day.

Then for the tuition fee naman, actually Matthew's tuition was paid in full already. I am saving for the next school year na and I just divide the tuition fee in 10 months to get the monthly allocation. We can save much when we pay the tuition fee in full kasi and by saving for it monthly, hindi ka mabibigla once pasukan na naman.

Of course, we need a weekly budget. Finally, I am able to allocate a real budget. As in budget na heto lang ang gagastusin mo for the week. Before, what we are doing is we will do a month grocery but ending up over spending because weekly nasa grocery din kami. That's why I told myself why not we do it weekly. I know sayang oras but then we always go to market naman every week so a quick grocery won't hurt naman.

Okay, how do I allocate our weekly budget. Listen, aww read pala! First, list down the basic needs like food, toiletries, and others that you need for a week. For us, I divide it with what I am buying from the market and what I am buying from the grocery. Here, it's very important that you have weekly menu for the food and to buy list because that will determine what you will buy and will help you stick with the budget.

Maybe you are asking if I always stick with the budget. So far, I am sticking with the budget naman. Discipline lang talaga and don't over stocked especially meats, vegetable and fruits. Just buy what you need for a week. Promise you can stick with the budget.

Aside from the 4 above, I also allocate money for our house's monthly amortization and credit card payment. Maybe you are wondering why I don't have allocation for the other utility bills? This is because we are using our credit card to pay all our bills online, except for our water bill. That makes our bill list simpler basta always have reminder to pay the bills online.

Also, you will see I have two other spaces for our two shops. In here, I put the payments we received so that I know how much we are earning.

Others naman will be saved for other planned expenses. Yes, we plan what we are buying now especially if we didn't need it just yet. Daddy and I agreed to only have one credit card installment plan per year. Or better if we can save for it then we'll buy it.

This year, I must say we have been a wise spender and have avoid impulse buying. Next year, I hope our budgeting/expenses/savings will be better.

So those are some money saving tips that I hope can help you too. Would love to read other saving tips from you too.